Beyond the traditional tools of funding through intellectual property such as licenses, new ways of raising funds using intangible assets are emerging: auctions (by auction houses specializing in this field), online tradings, trusts, mortgages, etc.

On which assets should you base your collateral?

- Patents

The patent portfolio of research companies is a valuable asset, provided it is kept under control. Under a mortgage, or a trust, the source of income, in order to be certain, requires the patent to be licensed.

- Trademarks, designs

If the trademarks are licensed, they can give rise to a certain and regular income. They offer a valuable guarantee if the business is successful. For instance, in the late 1990s DreamWorks and the Tussauds Group both granted security guarantee over their IP covering both existing and future IP[1].

Moreover, designs have the advantage of having a value independent from the company’s status. Therefore, they can be a guarantee of value for investors.

- Copyrights

Copyrights lasts up to 70 years after the author’s death : as such, once ownership and value are proven, they provide a valuable guarantee for the investor. Thereupon, the World Intellectual Property Organization (WIPO) has demonstrated that the taking of guarantees over copyright in the film and music industries is widespread and increasing in the biotechnology and software industries[2].

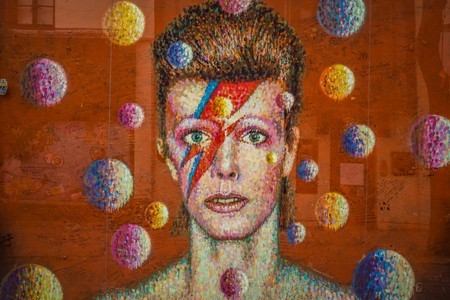

The forerunner of this financial innovation in intellectual property, David Bowie, will be remembered when he sold the “Bowie Bonds” which provided him with a regular income of over $1 million per year earned on the 25 albums he recorded before 1990.

It is therefore important to think of your intellectual property rights as real assets, and to reconsider the way they can be used: they can become effective security interests, especially for SMEs or start-ups that are launching their business.

This is true all over the world. For example, in India the government has introduced loan guarantee schemes through the possibility of mortgaging your trademarks or patents in order to encourage start-ups and cover the risk of real commercialization failures based on assets mortgaged by intellectual property rights.

To be continued!

It now appears possible to raise funds through your intellectual property assets. Dreyfus, an expert in legal issues related to intellectual property since 2004, helps you protect and enhance your rights and advises you on how to best manage your assets.

[1] [1]« Taking security over IP » Fieldfisher – February 2015

[2] « The Challenge of IP Financing » WIPO – September 2008