Sommaire

- 1 Introduction

- 2 The legal framework governing the payment of fees in plant variety protection

- 3 The Melrose case: a landmark dispute before the CJEU

- 4 Validation of electronic communications via MyPVR

- 5 Burden of proof and the holder’s heightened responsibility

- 6 Essential best practices for holders of plant variety rights

- 7 Conclusion

- 8 Q&A

Introduction

The decision delivered by the Court of Justice of the European Union on September 2, 2025 (Case C-426/24 P) marks a decisive turning point in the management of Community Plant Variety Rights (CPVRs). By confirming the definitive cancellation of a right for non-payment of an annual fee, the CJEU forcefully reiterates that the protection of plant innovations depends as much on the legal robustness of the title as on the administrative discipline of its holder.

This ruling, with major practical implications for breeders, seed companies, and agri-industrial groups, calls for a strategic and operational reading of plant variety protection law in the era of dematerialisation.

The legal framework governing the payment of fees in plant variety protection

The fundamental principle of maintaining the right

Regulation (EC) No 2100/94, which establishes the Community system for the protection of plant varieties, is based on a clear balance: in return for an exclusive right of exploitation, the holder must pay an annual maintenance fee.

In principle, failure to pay this annual fee within the prescribed time limits results in the definitive forfeiture of the plant variety right, save for limited circumstances in which the holder demonstrates, pursuant to Article 80 of Regulation (EC) No 2100/94, that an involuntary, exceptional, and duly justified impediment prevented compliance with the deadline.

A logic comparable to other intellectual property rights

Like patents or trademarks, a plant variety right is a living right, dependent on continuous vigilance. However, the specific feature of the CPVO system lies in its European centralisation and the growing use of digital tools dedicated to relations with right holders, in particular the MyPVR electronic platform, used for the notification of official acts, deadline management, payment of annual fees, and procedural exchanges with holders.

The Melrose case: a landmark dispute before the CJEU

The facts giving rise to the dispute

Romagnoli Fratelli SpA, the holder of a Community plant variety right for the potato variety Melrose, failed to pay the annual fee within the prescribed time limits.

The CPVO (Community Plant Variety Office) had nevertheless issued a debit note and several reminders, all made available via the MyPVR platform, with notifications sent by email.

The attempted restitutio in integrum

The holder applied for restitutio in integrum under Article 80 of Regulation (EC) No 2100/94, arguing that it had been prevented from meeting the payment deadline due to the lack of effective receipt of the notifications and contesting the validity of MyPVR as an official means of communication.

These arguments were rejected successively by the CPVO, the General Court of the European Union, and ultimately by the Court of Justice of the European Union, which held that failure to consult electronic notifications does not constitute an involuntary impediment within the meaning of Article 80.

Validation of electronic communications via MyPVR

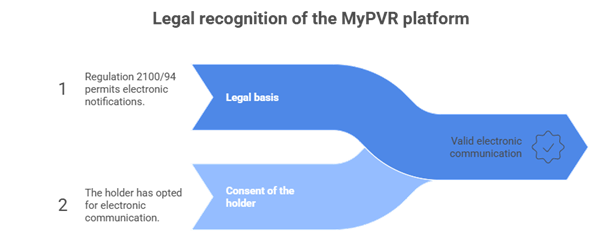

An explicitly recognised legal basis

The CJEU confirms that the President of the CPVO is empowered, under Regulation 2100/94, to determine the modalities of electronic notification. Accordingly, the MyPVR system is recognised as an official and legally valid channel for the service of acts.

The importance of the holder’s consent

A decisive factor lies in the fact that the holder had opted for electronic communication. This choice entails clear legal consequences: failure to consult the platform cannot invalidate the notification.

Burden of proof and the holder’s heightened responsibility

A firm position of the CJEU

The Court unequivocally states that the burden of proof lies with the holder. It was for the holder to demonstrate that the documents had not been made available in its MyPVR space or that the notification emails had not been sent. Failing such proof, the notification is presumed valid.

A heightened duty of diligence

This approach enshrines a logic of proactive responsibility: not seeing a notification does not mean it does not exist.

The CJEU thus elevates the administrative management of a CPVR portfolio to a strategic obligation, inseparable from legal protection.

Essential best practices for holders of plant variety rights

To avoid irreversible losses, we notably recommend:

- Regular monitoring of MyPVR;

- Continuous updating of electronic contact details;

- The implementation of redundant internal alerts;

- The use of a professional representative for portfolio management.

Conclusion

The CJEU decision of September 2, 2025 starkly illustrates the cost of administrative negligence in plant variety protection law. Failure to pay an annual fee, even in the absence of bad faith, may result in the definitive loss of a right of significant economic value. In a digital environment fully embraced by European institutions, vigilance is no longer optional; it is the very condition for the sustainability of rights.

Dreyfus & Associés assists its clients in managing complex intellectual property cases, offering personalized advice and comprehensive operational support for the complete protection of intellectual property.

Nathalie Dreyfus with the support of the entire Dreyfus team

Q&A

1. Can a cancelled plant variety right be refiled at a later stage?

In practice, refiling a plant variety right is very limited, as any new protection remains subject to novelty within the meaning of Regulation (EC) No 2100/94, as well as the DUS criteria, conditions that are rarely met after prior exploitation of the variety.

2. Is appointing a professional representative mandatory?

No, but it is strongly recommended to secure effective portfolio management.

3. Can the loss of a plant variety right affect a company’s valuation?

Absolutely. Plant variety rights are often strategic intangible assets. Their cancellation may impact financial valuation, acquisition audits, fundraising operations, or mergers and acquisitions.

4. Can failure to pay a CPVO fee trigger internal liability within a company?

Yes. In structured groups, forfeiture resulting from non-payment may give rise to contractual or disciplinary liability of the department or service provider responsible for portfolio management, particularly where economic harm can be demonstrated.

5. Does forfeiture of a plant variety right affect ongoing licence agreements?

Yes. Cancellation of the right generally removes the legal basis for licences, with potentially significant contractual consequences, particularly regarding royalties, warranties, and liability vis-à-vis licensees.

This publication is intended to provide general guidance to the public and to highlight certain issues. It is not intended to apply to specific situations nor to constitute legal advice.